Disruptive Innovation and Transformation of the Drug Discovery and Development Enterprise

Problem Statement

Declining or stagnant research and development (R&D) productivity has led many observers to argue that the current paradigm for drug discovery and development requires disruptive innovation (The term “disruptive innovation” is defined here as a transformation of the pharmaceutical industry driven by new technology, new business models, or policy decisions that improve therapy and create value for patients and society in a way that could not be achieved through other means) to break out of a current crisis by identifying and rapidly bringing new discoveries to market (Bowen and Casadevall, 2015; Elkins et al., 2013; Scannell et al., 2012; Paul et al., 2010; FitzGerald, 2011; Munos and Chin, 2011). The cost of bringing a new drug to the market has risen to approximately $2.6 billion over the last decade, up from the previous decade’s estimate of $1.5 billion (Tufts Center for the Study of Drug Development, 2015), and the overall likelihood of receiving regulatory approval from Phase I for all drug development candidates is 9.6 percent (Biotechnology Innovation Organization et al., 2016). Despite increased investment, the number of new therapies and improvements to human health as measured by the growth in life expectancy have remained relatively constant over the past 50 to 60 years (Bowen and Casadevall, 2015; Scannell et al., 2012). Sustained competition from generic manufacturers and overall negative public reactions to costly prescription drugs only add to the complex challenges facing large pharmaceutical companies (“industry”) today (Hartung et al., 2015; Howard et al., 2015).

Critics cite the need for the industry to produce more and better products and affordably innovate if it hopes to survive. To further assess the challenges and reveal potential opportunities, we undertook a qualitative research project to engage thought leaders and key stakeholders within the biomedical research ecosystem. Through soliciting the diverse viewpoints of these leaders (see Appendix A for those interviewed), we gained insight into their unique perspectives on the state of the pharmaceutical and biomedical research industries, what could or should change, how those changes might occur, and, generally, what the future might hold.

Interviews

We collected a variety of views on disrupting the drug development enterprise in order to ascertain forces that could serve as an impetus for change. Our goal was to bring forth ideas and themes to help inform leaders of research, funding, and product development organizations in the government, nonprofit, and industry sectors as they chart their future course through the drug discovery and development ecosystem.

We had discussions with 25 leaders from a range of positions and viewpoints in the drug development ecosystem. The interviewees represented various sectors, including industry, academia, patient organizations, venture capitalists, entrepreneurs, scientific journal editors, and industry consultants (see Appendix A for a list of interviewees). All quotations in this paper are from interviewees. A discussion guide (see Appendix B) provided a consistent structure for the interviews. Certain themes emerged as focal points of the discussion, which we explored further with discussants. We also sought feedback from participants in the Forum on Drug Discovery, Development, and Translation of the National Academies of Sciences, Engineering, and Medicine.

The interview process generated themes and ideas that covered the mood of the industry, the sustainability of the current R&D model, pathways for transformation, new research and development models, and potential future scenarios. The interviews revealed many unique, and plausible, visions of the future.

Strengths and Weaknesses of the Current Industry Model

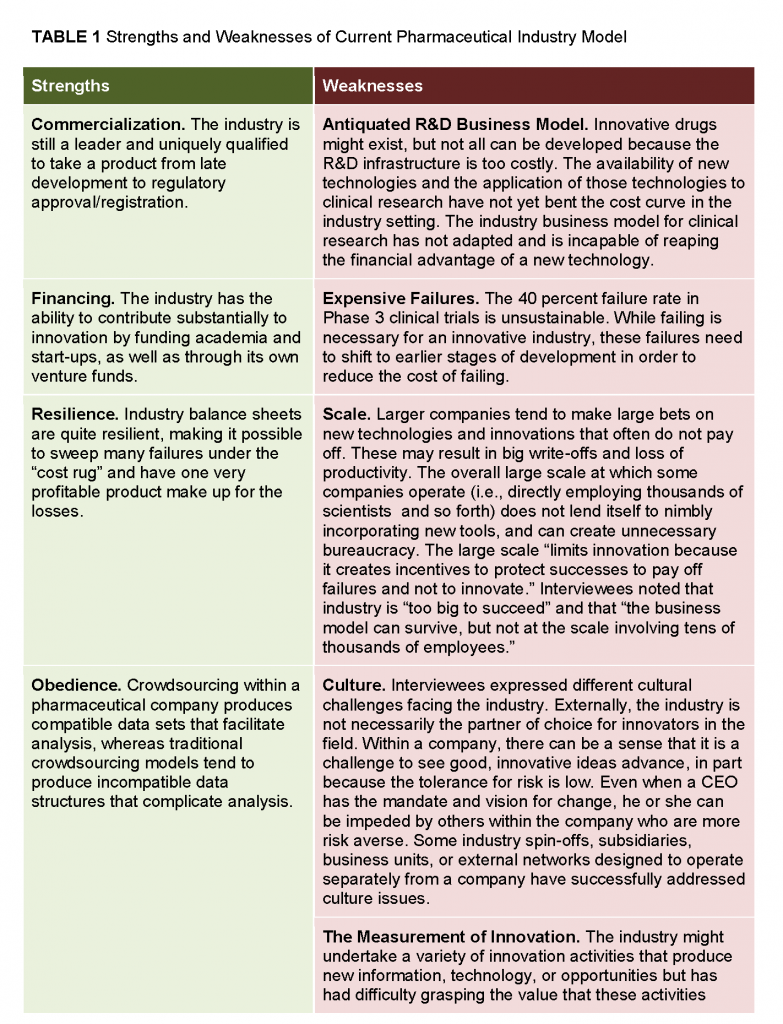

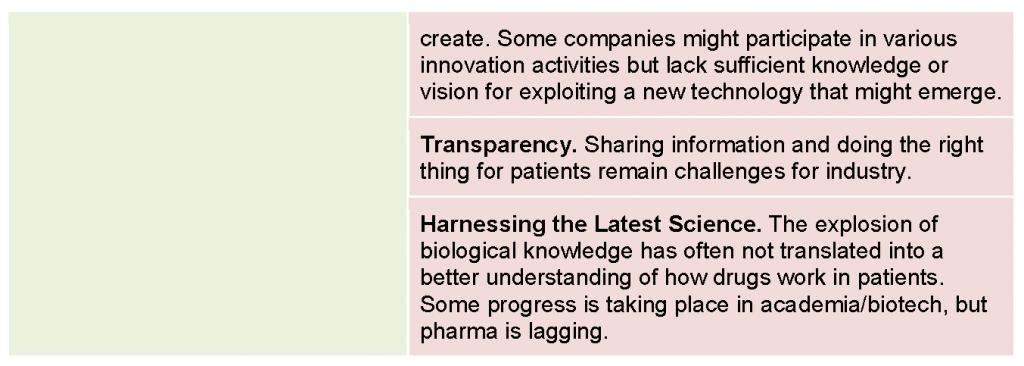

A synopsis of the strengths and weaknesses of the current pharmaceutical industry model, as identified by interviewees, is summarized in Table 1.

Observations on Sustainability

Interviewees generally agreed that the industry is facing significant, sustained challenges, but opinions regarding the breadth and pace of the transformation needed to address those challenges, and where the drivers for transformation would originate from, varied widely. One interviewee indicated that “we are not facing the beginning of the end, but we are in a process of accelerated transition.” Others suggested that the industry will undergo significant changes, perhaps even complete disruption, in the next decade. Still others believed that the large pharmaceutical company model has significant staying power because of its size, criticality, and lack of a large-scale viable alternative.

Several interviewees commented that there is mixed interest in disruptive innovation across the major pharmaceutical companies, because the traditional business model (i.e., developing and patenting a drug and marketing it to patients) still works reasonably well for many, and it tends to hide mistakes. Some indicated that although it is not unusual in this industry for large companies to be supplanted by smaller start-ups (as they become big companies), the important difference is that start-up companies breaking into the top tier could introduce new business models that might cause large companies to suffer substantial and enduring market share losses.

During the course of the qualitative research exercise spanning approximately 12 months, there seemed to be a sense of growing optimism about the state of the enterprise, possibly driven, in part, by positive trends in the number of novel drugs being approved by FDA—27 novel drugs approved in 2013, 41 in 2014, and 45 in 2015 (FDA, 2014, 2015, 2016). Evidence already suggests that new understandings of biological pathways are being leveraged for targeted products reaching the market (e.g., hepatitis C drugs, immuno-oncology products) and have greater clinical impact on patients’ lives than some of the incremental “me-too” products from a generation ago. Some interviewees said that it has taken a lot longer than originally expected, but the innovation we have been hoping for in the discovery and translation of new molecular targets has finally come. Recent successes have been attributed to a deepening of the science, greater ability to turn scientific insights into new medicines, and the evolution of a new investor base that is better at building successful companies.

Some pharmaceutical companies are beginning to evolve their R&D models. Partnerships and collaborations are increasing the flow of new compounds and approaches into pipelines and companies are exhibiting a greater willingness to invest in start-ups and incubator models with academic institutions. Some industry executives and R&D experts cite improved productivity (in the form of increasing numbers of novel drug approvals by FDA) as evidence that the industry model is effectively responding to the challenges. These trends lend support to the view that a gradual evolution of the current model is already happening and that a cataclysmic, disruptive change is therefore less likely to occur.

Discovery and Translation

Citing declining productivity from drug discovery efforts within industry, some observers argue that most insights for new drugs have been and will continue to arise from academia. One interviewee voiced pessimism, however, noting that “wrong incentives exist, such that the net productivity of a faculty member’s work is not taken into account when NIH [National Institutes of Health] funding is considered.”

Concern was expressed that the lack of sufficient funding—from the National Institutes of Health and others—for early stage discovery efforts will negatively affect the pace of bringing transformative therapies to market. One interviewee commented that “anything that can be done to get new technologies and innovations out of academia and into start-ups would be great.” Many interviewees suggested that more open, “precompetitive” research and data sharing could accelerate the pace of innovation and increase the flow of new molecules into development pipelines.

Some interviewees also pointed to the interface between industry and academia and the challenges in improving collaboration and integration across these sectors. The last few years have witnessed a proliferation of major pharma-academic alliances as many industry partners seek to grow their pipelines by gaining access to new scientific discoveries in academic or startup labs. Recent models in which industry has partnered with academia or small start-up companies include the following:

- “Pull” models, in which industry serves as the driver to bring new discoveries into its pipeline, such as Pfizer’s Centers for Therapeutic Innovation, the Novartis-Penn Center for Advanced Cellular Therapeutics, and others.

- “Push” models, in which academia drives the translation of discoveries into clinical candidates, such as the Tri-Institutional Therapeutics Discovery Institute, which partners Rockefeller University, Weill Cornell Medical College, Memorial Sloan Kettering Cancer Center, and Takeda Pharmaceutical Company Limited to support the development of small molecule drugs and antibodies.

- Public-private-partnerships, a collaboration model between academia/nongovernmental organizations and industry that has been successfully used to fill the gaps in translational science (e.g., Biomarkers Consortium, Alzheimer’s Disease Neuroimaging Initiative) as well as revive drug innovation for neglected diseases (e.g., TB Alliance, Medicine for Malaria Venture).

- Risk-sharing models (e.g., “built-to-buy” or option deals), in which a large company provides funding and other resources to a small company with unique technology, along with an agreement to buy it at predetermined terms at a later date if it has met certain milestones.

Many interviewees seemed to agree that tremendous potential exists for creating value at the interface between academia, industry, and start-up companies, which, if properly harnessed, could generate a stream of new therapies to fuel lackluster pipelines.

Clinical Development

Currently many efforts are under way to address the challenges of the clinical research enterprise and improve the efficiency of drug development. Many initiatives, such as the Clinical Trials Transformation Initiative, are already targeting opportunities for innovation and improved efficiency in the design and execution of clinical trials.

A number of interviewees noted that drug development, rather than discovery, is the source of greater inefficiency. The industry now has many innovative targets and drug candidates, but “the development infrastructure and process are getting in the way.” Many practices are flawed with respect to trial design, procedures, site qualification, recruitment, and informed consent, areas that offer significant opportunities for improvement. New technologies, including biosensors, electronic sourcing, risk-based monitoring, and electronic medical record–based recruitment tools, are already being piloted and implemented, paving the way for a major transformation of the clinical research enterprise. Combined with changes in the way clinical research is conducted—such as clinical research networks or Web-based “virtual” trials—these new technologies can bring about important savings that can change the economics of drug development.

Observations of FDA, NIH, and Academia

Many interviewees argued that FDA suffers from some of the same cultural issues that the industry faces. There is progressive thinking at the top, but, further down, managers can be reluctant to change. Yet, in these interviews, FDA received high marks for working collaboratively with industry. Still, some interviewees argued that the industry must do more to change its relationship to regulators. As one individual put it, “There are lots of things industry does to placate FDA that FDA actually has no interest in.”

Some interviewees believed that increasing competition for a limited pool of NIH funding has made basic research ultraconservative. There is a large supply of quality, if conservative, grant applications that tend to exhaust the funding available, with little money left for bold, but more speculative research. One individual lamented that “basic research is being neglected. It cannot get published in the top journals or get adequate funding.” Another suggested that “low success rates with grants are making NIH very conservative.” Grants go in priority to safe proposals. They are “not funding bold and deep ideas.”

One interviewee asserted that, within academia, most “don’t understand what it takes to translate great research into a drug.” Academia could place more emphasis on the importance of translational work, opportunities to partner with industry, and educating students about drug development. Another individual argued that “academia needs to be disrupted as much as industry. It does not deliver enough value for money.”

Visions of a Transformed Enterprise

Many different views were expressed during the interviews of what a transformed drug discovery and development enterprise might look like, although some common themes emerged. Disparate views were expressed on the need for transformation and its urgency, the degree to which transformation was already underway, and whether transformation would come from within or be imposed from the outside.

Many interviewees believed that we cannot transform the enterprise without changing the cost structure. But the question arose, “Can the industry change its cost structure, or will it be done by outsiders?” Until recently, the industry has faced limited pressure to change, but as margins are squeezed, the need for change is becoming more acute. The industry is also becoming more vulnerable to disruptive change wrought by an outsider operating with a totally different model.

For instance, one interviewee commented, “At the moment, drug R&D requires scale, but challengers are showing that it can be done with less scale, and perhaps differently, by sharing knowledge.” Some scale might still be needed for efficient global R&D, but that usefulness may be restricted to operational or executional activities. On the other hand, scale may be counterproductive for innovation. Innovation will be more intense and nimble in the future, and the large size of pharma will not help. This dichotomy may be leading some big pharma companies to focus on what is core to their mission—the execution of development programs—while leaving scientific innovation to academia and small biotech companies.

Vision #1: Industry Shifts Focus to Health Care Delivery

One possible vision that emerged from the interviews describes a shift in the mission and core purpose of large pharmaceutical companies to adjacent sectors of the health care industry. In this view, pharmaceutical companies will remain relevant by disrupting health care delivery, which some view as needing far more disruption than the pharmaceutical industry. The rationale is that health care is expensive but delivers little value, and pharmaceutical companies are well-positioned to introduce greater efficiencies, eliminate waste, and revolutionize the delivery of health care. This view takes the concepts of disease management, “patient centricity,” and “beyond the pill” to new heights, incorporating a commitment to address all aspects of health care delivery beyond pharmaceuticals. This effort would require a large-scale transformation of the pharmaceutical industry and an overall commitment that others may view as unlikely.

The pharmaceutical industry does have opportunities in this arena that are perhaps less grandiose than the vision articulated above. Specifically, pharmaceutical companies could lead the integration of clinical research with health care delivery, working with providers to embed continuous learning, including clinical trials, into information technology (IT) systems and electronic medical records, which thus far have been focused primarily on the delivery of clinical care. In this way, pharmaceutical companies would be a catalyst for a learning health care system, wherein care delivery is integrated with knowledge generation, mediated by next-generation electronic medical record systems and IT infrastructures.

Pharmaceutical companies could also play a larger role in providing wraparound care services, moving from medical product improvement to patient care improvement. This effort could include personalized approaches that improve the patient experience in the use of pharmaceutical products, facilitate compliance, and individualize the dose/dosing regimen for patients. A scenario in which industry plays a more direct role in health care delivery could require policy changes.

Vision #2: Technology Revolutionizes Medicine and Biomedical/Clinical Research

An explosion of digital technologies is already changing the way medicine is practiced and biomedical research is conducted. Mobile technology such as wearable sensors and telemedicine tools are making it easier to transmit high-quality data from remote sites to more central locations for data processing, clinical decision making, and clinical research. Telehealth could successfully move health care out of expensive, traditional medical institutions and usher in a more decentralized, lower-cost infrastructure approach to clinical drug development (see also Vision #3). High-technology companies are becoming increasingly engaged in the biomedical arena, contributing to innovations such as high-resolution imaging, plug-in devices, lab-on-a-chip, and data integration. An increase in self-diagnosis will likely be one result of new technologies, which could have broad implications for the delivery of health care, as well as the business model for pharmaceutical companies. Disruptions of this nature might come first from outside the United States “because their policies provide a different landscape for technology innovation.”

According to this vision for transformation, there will be less influence from direct-to-consumer advertising because people will use social media and other avenues to review symptoms, disease states, and potential treatments. The value proposition of patient groups will become even more pronounced for pharmaceutical companies as they become more engaged and lead with a stronger voice. Patients will have increasing control of their data, enabled by trusted data-collection platforms, such as those offered by high-tech companies (e.g., Apple’s ResearchKit) that are rapidly moving into the health care space. The increasing connectivity of digital networks will enable consumers to catalyze change such that “health care will be owned, operated, and driven by consumers.” Patients will be viewed not just as participants but as partners in their clinical trials. This more patient-centric view supports the decentralized model of clinical trials described in Vision #3.

Treatment management will also be revolutionized by biosensors; patients will use this information to gauge how effective their treatments are, and this feedback will affect whether they seek to switch to a different therapy or remain on the current one.

These technological advances have the potential to transform discovery research and encourage non-hypothesis-driven research; transform clinical research by making it easier and faster to enroll patients; provide the opportunity for real-time monitoring of trials and individual patients; and revolutionize the practice of medicine by allowing for the collection and integration of vast amounts of patient data. One interviewee noted, “Data analytics and mathematics applied to coherent data will be disruptive.” Another noted that the “future value will be found in reliable networks and predictive models that can match a drug to a particular patient, enabled through software development.” The huge amount of fine-grained biosensor data, together with network connectivity and powerful analytics, will provide unprecedented insights into disease biology, which will in turn foster novel therapeutic approaches. The cost of entry into this market will be cheaper—because much of the data and software will be free or available at very low cost—and the cost of failure will be lower.

Of course, a number of issues must be addressed before the full-scale adoption of the new technologies. The validation and qualification of biosensors and other technologies must be done in a way that is acceptable to regulators. Data privacy issues must be overcome. The streaming of massive amounts of data from multiple disparate sources may cause data overload and challenge our ability to filter out noise. The quality of data from various sources and the way the data are aggregated are additional challenges that must be addressed.

If the challenges of integrating new technologies can be overcome, the IT companies, such as Apple, IBM, and Samsung, may be better positioned to drive the development of digital health than the pharmaceutical industry. Will the pharmaceutical industry lose control over the collection and analysis of data flowing into the cloud? Will pharmaceutical companies become a less attractive partner for innovators? Unlike the pharmaceutical industry, the IT companies’ culture is nimble and not encumbered by a rigid regulatory mindset. Exploring and connecting data sets that have never been connected comes naturally to it and may be a great advantage in the new data-rich environment “Finding the right data at the right moment to develop the best predictive models will be disruptive.” For example, the Google X health care division has partnered with Duke and Stanford on a baseline study to capture the fullest picture of what a healthy human being should be. All these data exist increasingly outside pharmaceutical companies, potentially putting Google at an advantage over the pharmaceutical industry to better understand disease pathways and druggable targets.

Vision #3: A Complex Ecosystem Will Emerge Based on a Revitalized Business Model

In this vision, the roles of the various players in the health care ecosystem and the development of new products will continue to evolve, while the coexistence of diverse business models will foster competition and improve value. Some observers predict that pharmaceutical companies will become smaller with a lighter infrastructure. In this view, industry will focus less on discovery and more on the development of new drugs, relying on small biotech companies and academia to produce the new molecules they need to fuel their pipelines. Translational research will have multiple sources of funding, including venture capital, industry, disease foundations, and so forth, but only NIH will fund basic science. Pharmaceutical companies may drive changes in health care delivery, such as improving the patient experience and real-world outcomes as described in Vision #1. Or they might seek innovation in the execution of clinical research, exploring new models to conduct clinical trials that are more efficient and less costly, such as the use of distributed research networks linking various alternative clinical settings or Web-enabled “virtual” trials. Decentralization of clinical trials has the potential to transform the conduct of clinical trials and dramatically reduce the infrastructure costs associated with drug development. In this more patient-centric view, the “elimination of central research sites,” facilitated by digital technologies, “enables patients to become the site of data acquisition.”

Lowering the cost of innovation will have profound implications on the structure of the industry and the economics of health care. If it becomes cheaper to innovate, more players will do it, which will increase the supply of new drugs that can be priced more affordably. Scale, which has historically been an asset, will be less of a success factor. Diversity, rather than scale, will become the new hallmark of the industry. The large companies that can remake themselves and adjust to the new environment will continue to thrive, but others may struggle and fall behind.

Diversity will also be seen in new business and research models that will closely collaborate with each other. Data sharing and precompetitive cooperation—long viewed with skepticism by the industry—will be readily embraced. Consortia, public-private partnerships, and crowdsourcing platforms will expand and become key players in the new innovation ecosystem.

Patients and nonprofits, such as the Bill and Melinda Gates Foundation, will be important catalysts in the transformation of that ecosystem. Patients, who will increasingly control data collection, will use that leverage to advance data sharing, transparency, and open science, while nonprofits, committed to producing affordable innovation, will keep supporting low-cost innovation models, some of which will eventually become mainstream.

Note: The authors were assisted by Emily R. Busta, MS; Anne B. Claiborne, JD, MPH; Christopher J. DeFeo, PhD.; and Rebecca A. English, MPH of the National Academies of Sciences, Engineering, and Medicine.

Appendix A

Interviewees included the following:

- Jeff Allen, Executive Director, Friends of Cancer Research

- Linda Avey, Cofounder, Curious, Inc., and Cofounder, 23andMe

- Alpheus Bingham, Founder and Member, Board of Directors, InnoCentive

- Doug Crawford, Associate Director, QB3, California Institute for Science and Innovation

- Steven Cummings, Professor of Medicine, Epidemiology and Biostatistics, Emeritus, University of California, San Francisco

- Standish Fleming, Managing Partner, Forward Ventures

- Dalvir Gill, CEO, TransCelerate BioPharma Inc.

- David Grainger, Venture Partner, Index Ventures

- Magali Haas, Founder and CEO, Orion Bionetworks

- Amir Kalali, Vice President, Medical and Scientific Services, Global Therapeutic Team Leader CNS, Quintiles

- Peter Kirkpatrick, Chief Editor, Nature Reviews Drug Discovery

- Kelly LaMarco, Senior Editor, Science Translational Medicine

- Robert Langer, David H. Koch Institute Professor of Chemical and Biomedical Engineering, Massachusetts Institute of Technology

- Craig Lipset, Head of Clinical Innovation, Pfizer

- Roger Longman, CEO, Real Endpoints

- Derek Lowe, Heavy Duty Industrial Scientist, Vertex

- Tom Main, Partner, Founder of the Oliver Wyman Health Innovation Center

- Kal Patel, Chief Commercial Officer, Doctor on Demand (Global Marketing Lead—Enbrel, Amgen, at the time of the interview)

- Arti Rai, Elvin R. Latty Professor of Law, Duke University

- Mike Rea, Partner and CEO, IDEA Pharma

- David Shaywitz, Chief Medical Officer, DNAnexus (Senior Director, Strategic and Commercial Planning, Theravance, at the time of the interview)

- Melissa Stevens, Executive Director, Center for Strategic Philanthropy, Milken Institute (Deputy Executive Director, FasterCures, at the time of the interview)

- Marc Tessier-Lavigne, President, Rockefeller University

- Eric Topol, Director, Scripps Translational Science Institute

- John Wilbanks, Chief Commons Officer, Sage Bionetworks; Senior Fellow, FasterCures

Appendix B

Discussion Guide

This discussion guide has been designed to engage respondents and seek their opinions and ideas on topics that are likely to influence change in the pharmaceutical industry over the next decade. It opens the discussion with questions about the sustainability of the industry model and follows with questions on the three drivers that are likely to reshape the industry, i.e., new technologies, new business models, and policy decisions. Respondents are expected to vary in their opinions on the status of the industry and the need, speed, and breadth of the change that is likely to occur. There is no right or wrong answer. The goal of these interviews is simply to identify the factors that are likely to play a role in the industry’s future.

For purposes of this discussion, “disruptive innovation” is defined as a transformation of the pharmaceutical industry driven by new technology, new business models, or policy decisions that improve therapy and create value for patients and society in a way that could not be achieved through other means. While a discussion of the theory of disruptive innovation is worthwhile in a number of venues, this conversation is meant to focus on the unique challenges and opportunities for the pharmaceutical industry to harness innovative forces, those forces that are emerging as well as those that are still unknown, for societal benefit. We are particularly interested in learning about the potential for truly dynamic and disruptive innovation (as opposed to marginal innovations that modify the ecosystem only slightly).

Attitude vis-à-vis Sustainability

Some commentators have argued that the pharmaceutical industry faces a triple challenge: it must produce more, better, and affordable innovation. Can it successfully address those three challenges, or are we trying to square the circle? (If it cannot address all three challenges, what are the ones that cannot be tackled?)

In 2013, on average big pharma spent $5.4 billion in R&D. Since 2000, new molecular entity (NME) production for big pharma has been flat and has averaged 0.85 NME per company and per year. Seventy percent of these drugs end up not being blockbusters and peak at about $400 million. Is this sustainable? Does R&D create or destroy value?

Several big pharma CEOs, such as Messrs. Witty and Viehbacher, have gone on record claiming that big pharma’s return on R&D is negative, perhaps losing as much as $0.30 for each dollar spent on research. Is their math right?

Big pharma companies collect on average 50 percent of their sales from products that have been in the market for 12 years or more and are—or are about to become—generic. Managing these products and keeping them going consumes a significant amount of executive attention. Can companies truly innovate and reinvent the future when so much of management’s attention is focused on the past?

New Technologies

A growing number of new therapies in development do not involve drugs—things such as cell therapy, gene therapy, gene editing, immune therapies, apps that retrain the brain, nanomedicine, etc. Yet, with some exceptions, large companies are not prominent in these fields. Why is that? Is there a risk that existing companies may fall behind in their ability to translate these new biomedical discoveries?

The great translational successes of the past—insulin, antibiotics, rDNA, monoclonal antibodies, etc.—were achieved by companies that seized upon immature technologies and turned them into new therapies. Today, companies—including some of the same—seem less prone to do that. Why this reluctance? Can this be somehow linked to the innovation challenges experienced by the industry?

New data capture technologies such as biosensors and plug-in devices promise to give us more health data than we ever had. This could impact the way we do research. What do you think this impact might be? Are pharmaceutical companies prepared to deal with a future in which a lot of the data may not come from randomized controlled trials and will be collected, stored and owned by someone else?

New Business Models

New business models such as precompetitive research, crowdsourcing, networked innovation, virtual companies, drug repurposing, and forced disruption (e.g., DARPA) are spreading and enriching the biomedical innovation ecosystem. The pharmaceutical industry has not always been quick to embrace them. Is this changing? Can the pharmaceutical industry leverage some of these models to become better innovators? Are these models synergistic or antagonistic with the current pharma model? How will they impact the economics of drug R&D, as well as its size and profitability?

Policy Changes

Payers around the world have become increasingly assertive in challenging intellectual property (IP) or capping drug prices. Will this ease or worsen in the future? How to best deal with these threats?

What might happen if the US government were to become involved in drug price negotiations? How realistic is this prospect?

References

- Biotechnology Innovation Organization, Biomedtracker, and Amplion, Inc. 2016. Clinical development success rates, 2006–2015. Available at: http://bit.ly/22o5TGf?_ga=1.226529307.727240812.1464361380 (accessed May 27,

2016). - Bowen, A., and A. Casadevall. 2015. Increasing disparities between resource inputs and outcomes, as measured by certain health deliverables, in biomedical research. Proceedings of the National Academy of Sciences USA 112(36):11335–11340. https://doi.org/10.1073/pnas.1504955112

- Elkins, S., C. L. Waller, M. P. Bradley, A. M. Clarke, and A. J. Williams. 2013. Four disruptive strategies for removing drug discovery bottlenecks. Drug Discovery Today 18(5–6):265–271. https://doi.org/10.1016/j.drudis.2012.10.007

- FitzGerald, G. A. 2011. Re-engineering drug discovery and development. LDI Issue Brief 17(2):1–4. Available at: https://europepmc.org/article/med/22049582 (accessed July 27, 2020).

- FDA (Food and Drug Administration). 2014. Novel new drugs 2013 summary. Available at: http://www.fda.gov/downloads/Drugs/DevelopmentApprovalProcess/DrugInnovation/UCM381803.pdf (accessed May 27, 2016).

- FDA. 2015. Novel new drugs 2014 summary. Available at: http://www.fda.gov/downloads/Drugs/DevelopmentApprovalProcess/DrugInnovation/UCM430299.pdf (accessed May 27, 2016).

- FDA. 2016. Novel new drugs 2015 summary. Available at: http://www.fda.gov/downloads/Drugs/DevelopmentApprovalProcess/DrugInnovation/UCM481709.pdf (accessed May 27, 2016).

- Hartung, D. M., D. N. Bourdette, S. M. Ahmed, and R. H. Whitham. 2015. The cost of multiple sclerosis drugs in the US and the pharmaceutical industry: Too big to fail? Neurology (84)2185–2192. https://doi.org/10.1212/WNL.0000000000001608

- Howard, D. H., P. B. Bach, E. R. Berndt, and R. M. Conti. 2015. Pricing in the market for anticancer drugs. National Bureau of Economic Research Working Paper 20867. Available at: http://www.nber.org/papers/w20867.pdf (accessed July 11, 2016).

- Munos, B. H., and W. W. Chin. 2011. How to revive breakthrough innovation in the pharmaceutical industry. Science Translational Medicine 3(89)89cm16. https://doi.org/10.1126/scitranslmed.3002273

- Paul, S. M., D. S. Mytelka, C. T. Dunwiddie, C. C. Persinger, B. H. Munos, S. R. Lindborg, and A. L. Schacht. How to improve R&D productivity: The pharmaceutical industry’s grand challenge. Nature Reviews Drug Discovery 9(3):203–214. https://doi.org/10.1038/nrd3078

- Scannell, J. W., A. Blanckley, H. Boldon, and B. Worrington. 2012. Diagnosing the decline in pharmaceutical R&D efficiency. Nature Reviews Drug Discovery 11(3):191–200. https://doi.org/10.1038/nrd3681

- Tufts Center for the Study of Drug Development. 2015. Outlook 2015. Boston: Tufts University.